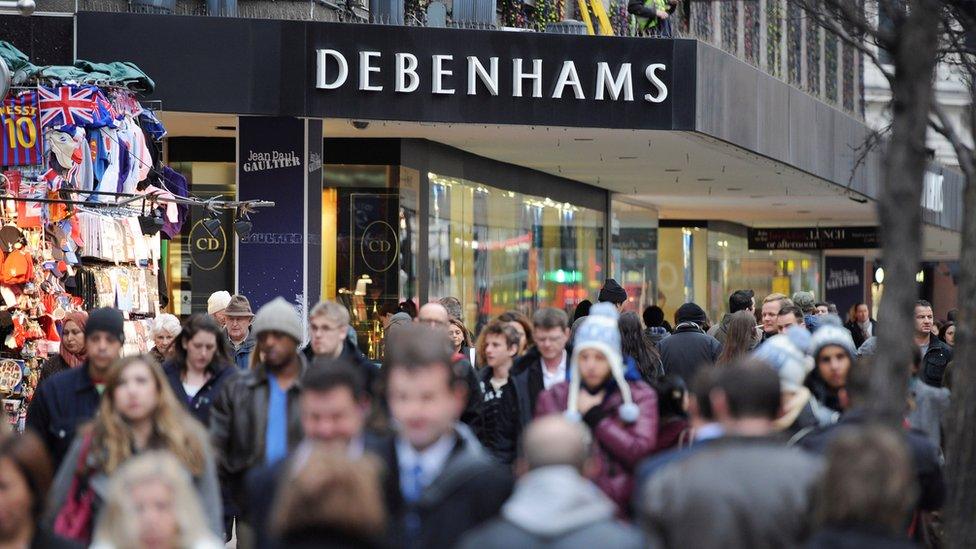

Debenhams to cut 320 store management jobs

- Published

Department store group Debenhams is planning to cut 320 store management jobs as it tries to drive down costs.

The retailer said last month it was stepping up cost-cutting plans after it issued a profit warning following disappointing trading over Christmas.

Many traditional retailers are struggling to cope the challenge of the shift towards shopping online.

Debenhams said a review had identified "significant cost savings" by reducing the complexity of management roles.

The 320 posts affected account for a quarter of Debenhams' store management jobs.

"We are currently consulting with individuals affected and will seek redeployment opportunities where possible," Debenhams said in a statement. "We envisage our new structure being fully in place by the end of March."

The news comes shortly after three of the UK's biggest supermarket chains - Tesco, Sainsbury's and Morrisons - announced plans to cut thousands of jobs, including stripping out layers of middle management.

Analysis: Emma Simpson, ≥…»ÀøÏ ÷ business correspondent

Who'd want to be a manager on the shop floor in retail right now? Judging by the spate of announcements from some of our biggest retailers in the last few weeks, these posts are now on the chopping block.

First it was the supermarkets, with all the big established grocers restructuring their businesses as the old supermarket model is under strain, from rising costs, increased competition and the relentless shift to online.

Now it's the turn of Debenhams. It's not surprising given the pressures on its department store business. It already said it would have to find £10m of savings this year. In the world of retail, there's much more change to come.

'Year of distress'

Shares in Debenhams fell sharply in January after it said its UK like-for-like sales - which strip out the impact of store openings and closures - fell 2.6% in the 17 weeks to 30 December amid a "volatile and competitive" market.

As a result, it cut its full-year profit forecast to between £55m and £65m this year, against analysts' expectations of about £83m.

Debenhams - which operates out of more than 240 stories in 27 countries - is by no means the only High Street retailer to have struggled recently.

The whole retail sector is undergoing huge change as traditional stores seek ways of coping with the rapid rise of online shopping.

Marks and Spencer, House of Fraser and Mothercare were among other retailers to report disappointing sales in the run-up to Christmas, whereas online specialists such as Asos and BooHoo saw rapid growth in revenues.

Richard Lim from research consultancy Retail Economics said: "2018 is looking like a year of distress for the UK retail industry.

"The major challenge facing bricks-and-mortar retailers is the continued pincer movement of rising operating and sourcing costs against a backdrop of shifting shopper behaviour.

"Many retail business models are incompatible with the relentless shift towards online spending and the emergence of the experience economy. Put simply, department stores are incredibly expensive to operate while they are also burdened with inflexible leases, high rents and too many properties."

- Published4 January 2018

- Published11 January 2018