EU launches new raid on the City

- Published

- comments

Reef life may include sharks

The EU Commission is mounting another attempt to steal trillions in trading business from London by insisting that euro denominated deals should be settled in the EU.

After Brexit, that would obviously exclude London where the vast majority is currently done.

That has always been a major grievance for other European capitals who sense an opportunity to restart an old fight for a big prize.

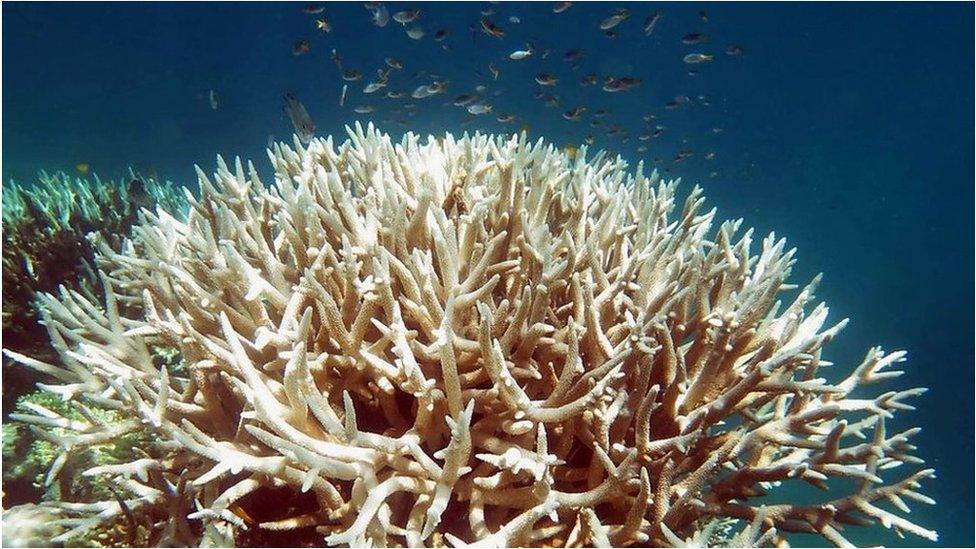

London's financial district - or "The City" - is like a coral reef. It has grown into a complex ecosystem over hundreds of years with lots of specialist organisms feeding off each other.

The coral is home to plants and anemones which in turn are home to fish, and crustacea of dazzling variety.

Bankers and traders may be the apex predators but there are lawyers, accountants, insurance brokers and tech workers swimming around them.

Clownfish

It's very hard to replicate but that doesn't mean it can't be damaged. If you chip a bit off - you lose a few of the resident clownfish too.

That rather extended metaphor is perhaps one way to think about the subject of euro clearing. It's a very basic, boring and yet incredibly important bit of the reef.

Clearing is the process by which a third party organisation acts as an intermediary for both buyer and seller.

They deal with the clearing "house" rather than each other which centralises everything and makes the whole complex business easier and quicker. 75% of all everything bought and sold in euros - anywhere in the world - is cleared in London - some 850 billion euros EVERY DAY.

Clearing houses also bear the risks that once side of the transaction doesn't cough up.

In return for that risk, buyers and sellers have to keep money in a special account with the clearing house in case there are problems. The more business you do with them, the less money proportionately of your trading volumes you need to keep in that account. Bigger clearing houses are therefore cheaper for their customers.

Stealing

If you start chipping bits off the reef and carting them off to Europe those costs could rise. Some estimates put the cost of fragmenting this bit of the reef at an additional 77bn euros to the people that use them.

It would cost UK jobs too. An Ernst and Young study last year estimated that over 80,000 UK jobs would go if euro-clearing moved from London.

Other financial centres have tried for years to steal this business. In fact, the European Central Bank in Frankfurt tried to insist that all euro trades in the EU were done inside the eurozone. A policy it had to scrap when the European Court of Justice ruled in 2015 it discriminated against non-eurozone countries who are part of the EU.

If that court case is run again once the UK is outside the EU, that defence no longer works.

Cold sick

This new raiding party is led by the EU Financial Services Commissioner Valdis Dombrovskis, who is arguing that either the EU has greater policing powers over clearing in London (a cup of cold sick in political and regulatory terms) or, the business has to relocate to the EU (two cups).

It's not clear, however, that a defeat for London would be a victory for the EU. Some euro clearing also happens in the US and many think that the way firms will minimise the cost of disruption and fragmentation will be to do their business in New York - another big reef - which would only serve to weaken Europe as a whole in the global financial power league.

That is what Chancellor Philip Hammond was getting at when he warned that the UK and Europe "should be careful of any proposals which might disrupt growth, raise the cost of investment in Europe and the UK or weaken financial stability".

New York is watching closely on the sidelines as the battle for Britain's finance industry starts in earnest.